Sustainability or Environmental, Social and Governance (ESG) has become an increasingly popular topic in investment management.

More and more investors want their portfolio “to do good” in addition to generating strong returns.

However, the question is whether “doing good”, or investing in more sustainable companies, comes at a price to the investor. After all, shouldn’t companies that don’t clean up the environmental damage they cause, who don’t invest in their employees and pay them poorly have stronger financial performance as they save cost? While cost savings may exist in the short term, longer-term these companies’ financial results tend to suffer. Treating employees poorly decreases work morale, reduces the talent pool and increases employee turnover. Bad behaviour also increases the risk of bad publicity and the likelihood of costly lawsuits and even consumer boycotts which can hit bottom-line results.

Most academic studies have found that there isn’t any performance penalty associated with ESG investing.[1] On the contrary, there may be a long-run return premium associated with companies that manage their affairs in a responsible and sustainable manner. Responsible and sustainable operations are also often associated with lower risk.

At GSI we tilt our portfolio towards companies with desirable characteristics, namely we tilt towards companies that are smaller, better value and those that have stronger profitability than their peers. We also tilt towards companies with more sustainable operations reflected in a higher ESG score.[2] Those are the companies that are well-positioned for long-term financial success.

To illustrate our belief that strong ESG performance can lead to strong long-term financial performance, we explore a case study, Red Electrica Corporation, a Spanish electric utility, that takes a holistic approach to sustainability.

Red Electrica Corporation

Red Electrica focuses on the management of the Spanish high-voltage transmission grid and is responsible for the development, maintenance and improvement of the network’s installations. Its activities also include coordination among the generation, transmission and distribution process of electric energy and the development of energy storage infrastructure. The company operates in Spain and in a number of other countries, such as the Netherlands, Luxembourg, Peru, Chile and France.

Since its creation in 1985 the company has had a strong focus on ESG, long before that term even existed. Since 2005 Red Electrica has been included in the Dow Jones Sustainability World Index. In 2008, the investment bank Goldman Sachs placed Red Electrica among the top seven utilities companies in the world that are notable in terms of return on capital, position, environmental management, social issues and corporate governance.

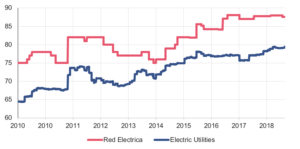

Red Electrica’s ESG score has always been considerably higher than the industry average. The graph below shows that the company’s ESG score has risen from 75 in 2010 to a current value of 88.

ESG Scores

Source: Sustainalytics, Factset.

As most of the company’s activities are regulated by government, it generally does not have any pricing power. Instead, in order to increase financial performance, it can increase the efficiency of its operations by cutting costs and it can try to boost production and new investments in the same or similar lines of business to expand its revenue base.

Red Electrica’s sustainable business model has helped the company greatly in these efforts. For years, investment in integrating renewable energy sources into the power grid has been a major focus of the company, which has not only helped the environment, but it has also helped increase its revenue and profitability. In fact, Red Electrica’s revenue increased steadily from about €1.4 billion in 2010 to almost €2 billion in 2018. Its gross operating profit increased from about €1 billion in 2010 to more than €1.5 billion in 2018. The company’s investment in renewables integration over 2018-2022 is planned to be approximately €1.5 billion representing about 25% of its entire planned investments.

The company’s activities are aimed at facilitating the energy transition and enabling proper integration of renewable energy sources, with the ultimate goal of driving progress towards a low-carbon economy. Red Electrica’s Environmental score (the “E” out of ESG) is 85 out of 100 which corresponds to the 98th percentile of all companies.

Red Electrica is also involved in a pumped-storage hydropower plant in the Canary Islands, an energy storage infrastructure that will contribute to move towards a new, more secure, efficient and environmentally friendly energy model. Projects such as this have helped to further raise the company’s credibility as an innovator in the environmental space, thereby generating additional business opportunities.

Through the company’s dedicated investment in its employees through work-life balance programs, investment in training and development as well as a fair compensation system, the company has created a very loyal workforce. Employee turnover levels are one of the lowest across all companies. Employee turnover in 2018 was 2.4% per year. It has also contributed to very low work absenteeism. Moreover, from 2010 the company has spent close to €4,000 per year on investment in training per employee, again among the highest of any company.[1] This has been reflected in the company’s extremely high Social score (the “S” in ESG) of 91 (or the 99th percentile). Red Electrica’s social efforts have had a significant and measurable impact on its corporate performance.

On the governance side (the “G” in ESG), Red Electrica strives for maximum transparency and fairness and in that effort, it has been tracking key metrics since 2010. Its share of female members on the board of directors increased steadily to 41.7% as of 2018. All board committees are made up exclusively of external members thereby ensuring independence. The level of attendance at board meetings is close to 100% (97.7% as of 2018).[2] This level of dedication to governance issues ensures effective decision making and control in the interest of the company and its stakeholders rather than only one particular special interest group such as management. It is reflected in a very high governance score of 88 out of 100 (corresponding to the 99th percentile).

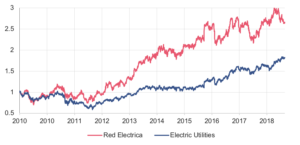

At GSI we have a strong overweight in Red Electrica in our portfolio relative to the company’s market weight. The company exhibits strong financial performance and it has been serious about ESG for many years which is reflected in its day-to-day operations and in the systems it has put in place to monitor, facilitate and measure its sustainability efforts. Red Electrica has demonstrated that it is a company with strong values and a leader in innovation in all areas of business, including sustainability. It has successfully demonstrated that sustainability efforts can be a strong driver of financial growth. The company has strongly outperformed its industry peers in electric utilities as shown in the graph below.

Cumulative Total Stock Returns (in GBP)

Source: Factset.

Please remember that past performance is not necessarily a guide to future performance, the performance of funds is not guaranteed, and the value of your investments can go down as well as up, so you may get back less than you invested. When investments have particular tax features, these will depend on your personal circumstances and tax rules may change in the future. Fees and expenses are deducted from capital, so whilst this maintains the level of income it may restrict the level of capital growth and could lead to a reduction in capital value.

GSI does not provide investment advice. If you are unsure whether an investment is suitable for your needs or circumstances, you should seek independent professional advice. Before investing in a fund please read the Key Investor Information Document, Prospectus and Fund Supplement for full information.

IMPORTANT INFORMATION

This document is issued by Global Systematic Investors LLP (“GSI”) and does not constitute or form part of any offer or invitation to buy or sell shares. It should be read in conjunction with the Fund’s Prospectus. GSI is authorised and regulated by the Financial Conduct Authority. The company’s registered office is 75 King William Street, London, EC4N 7BE.

The price of shares and income from them can go down as well as up and past performance is not a guide to future performance. Investors may not get back the full amount originally invested. A comprehensive list of risk factors is detailed in the Prospectus and an investment should not be contemplated until the risks are fully considered. The Prospectus can be viewed at www.gemini-im.com.

The contents of this document are based upon sources of information believed to be reliable. GSI has taken reasonable care to ensure the information stated is accurate. However, GSI make no representation, guarantee or warranty that it is wholly accurate and complete.

The GSI Global Developed Value Fund (“the Fund”) is a Sub-Fund of GemCap Investment Funds (Ireland) plc, an umbrella type open-ended investment company with variable capital, incorporated on 1 June 2010 with limited liability under the laws of Ireland with segregated liability between Funds.

The Company is authorised in Ireland by the Central Bank of Ireland pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2003 (S.I. No. 211 of 2003) (the “UCITS Regulations”), as amended.

Gemini Investment Management Ltd is the appointed Global Distributor and is responsible for the oversight of all distribution arrangements for the sub-fund. GSI are the appointed sub-distributor for the fund.

[1] https://www.ree.es/en/shareholders-and-investors/sustainable-investment/performance.

[2] https://www.ree.es/en/shareholders-and-investors/sustainable-investment/performance.